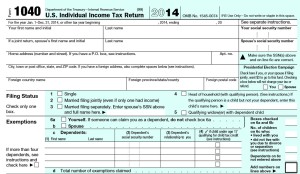

The case was filed with the understanding that the debtor would go ahead and file the most recent four years of taxes within 1 to 2 weeks of the date of filing. The debtor did have those taxes prepared however he was not able to pay the tax preparers entire fee. For this reason, copies of those returns were not furnished to the debtor and thus not turned over to the debtor’s attorney or to the chapter 13 trustee.

If the chapter 13 trustee does not receive proof of the federal tax return filings within 46 days of the bankruptcy case filing, then the case is automatically dismissed. In this particular case, the chapter 13 trustee brought a motion to dismiss for failure to provide proof of those federal tax filings. This means that the debtor will have to refile the case and start over again. He may or may not have to take the credit counseling session depending upon whether it’s been more or less than 180 days since his last credit counseling session. He will have to provide the most recent two months’ worth of paycheck stubs just before filing once again. And most importantly, he will need to provide the four years of federal tax returns. The filing of a new case will result in a new meeting of creditors as well as additional motions by the debtor’s attorney, including a motion to extend the automatic stay.

If you as a debtor have a case dismissed within one year of filing a new case, then the automatic stay will only last for 30 days after filing unless otherwise extended. In a motion to extend the stay, the debtor must show what change in circumstances have occurred or why it is more likely than not that this case will be successful when the prior case failed. Your bankruptcy attorney will help you in crafting the proper motion with the proper evidence to back it up.

The lesson from this blog is that the federal rules surrounding chapter 13 bankruptcy are important. If you fail to adhere to any of the rules, you are subject to significant consequences. In this particular case, the failure to provide the federal tax returns resulted in a dismissal of the case. This can then lead to repossession, garnishment, bank seizure and other collection efforts that would’ve been completely avoided if the first case would have survived. You must follow the advice of your counsel and follow through on the specific requirements of your case.

Some attorneys simply will not file the case until they have all the documentation in hand. I will often allow the debtor to come up with documents later in an effort to facilitate a quick filing. I have found in my experience that most bankruptcy clients will comply and will provide the documentation shortly after filing. However, there are always a small percentage of people who simply find it difficult to follow through on what they set out to do. This is what happened in this particular dismiss case where the debtor did not provide the four years of federal tax returns.